Invest your money! But be smart

December 7, 2021

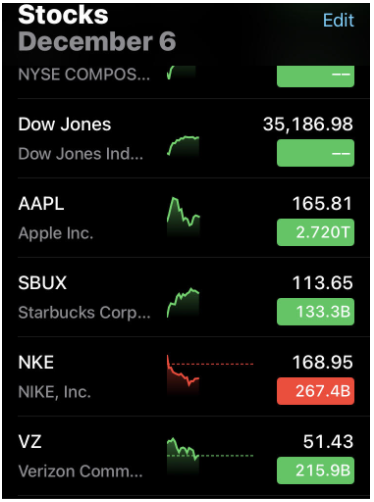

18-year-old Owen Alderink checks for the second time this morning the performance of his cryptocurrency Shiba Coin.

Up 11.3%.

He smiles as he watches his money grow, proud of taking the advice from someone he heard on Tiktok.

Next week will be the same, investing some money he made from his job at Ace Hardware when the market dips, constantly chasing the excitement of the highs and lows of the stock market.

Maybe he will put a couple of extra dollars in one day because Elon Musk replied to a new unknown cryptocurrency Twitter page, awaiting the surge and buzz the coin will suddenly receive.

This strange world of investing can make little sense to those on the outside.

For those involved, it is a very exciting way of potentially earning money, almost like a game.

However, the main mistake of those entering into the investing is viewing it as a game–to become caught up in the excitement and not think of the risks.

Despite the stories of people making millions off of Tesla stock or Bitcoin, not everyone will strike it rich with investing.

And when a new investor jumps into putting their money in random stocks that are popular at the moment without even knowing how the investing space works, it is not going to turn out well.

With the complexity and uncertainty of investing, teenagers need to know what to invest in for their wants.

If their goal is to make thousands of dollars through investing, the way to go about it will not be the same as someone just wanting to play around with the extra change they found on the sidewalk.

Investing requires a vast knowledge of the financial space, so talking to a financial advisor or someone with experience in investing is crucial for teenagers getting into investing.

Even with this vast knowledge, every investor needs to be prepared to lose everything they put in. No matter how much money someone can have in stocks, bonds, and crypto, it is important to know that shares and coins can lose their value out of thin air.

All the money put into it, gone.

For most teenagers, investing a big chunk of their money (especially without a steady income) is not wise.

They need to save money for the start of their adult life and college.

When most of their money is sitting in bonds that they can’t take out until retirement, young and financially unstable people should not be taking these huge risks.

Along with being cautious with putting a hefty amount of money into any form of investment, avoiding high-risk investments needs to be considered for investors of all ages.

Risky investments with a limited history and very irregular patterns such as crypto coins and non-fungible tokens (NFTs) should not be a way teenagers think they are going to get rich.

“I just see it (cryptocurrency) as something new and exciting to have. It is risky, but I didn’t put that much money in that it will harm me if I lose it. But watching all the hype and the values rise is fun; that’s why crypto is popular right now,” says Alderink.

Investments such as cryptocurrency can be interesting and unique, but with the uncertainty of these new investments, they might not be the best choice for someone like a teenager with a plenty of time for their investments to grow.

There are many risks to consider when investing, but when someone is prepared and knowledgeable of the space, investing is an important and useful tool for teenagers to potentially grow their wealth.

“I think investing is super important. It has worked for my kids and even though I’m older and getting in late it has helped me too. But for young people who want to invest, start as soon as you can because of the huge amount of time your money has to build up. And I would recommend bonds and index stocks because of how long younger people have to build up this money,” John Rowe said.

Many people like Rowe have found their success investing in the group of stocks and other investments instead of just putting money into individual shares.

Often known as index stocks or funds, these investments comprise of many different stocks usually sharing the same industry so that an investor can own parts of a whole industry instead of individual companies. By doing this, investors can reduce risks further.

Again with bonds and index stocks, research of what industries can rise to power in the future is needed.

It is great that more people are getting into investing young and old, but they need to remember that safer investments are long-term and research is needed before investing.

With this teenagers can enter into the investing world without worry, confusion, and unnecessary risk.