Watch the money grow

November 22, 2021

You can make money without work! It is true; if you invested $15 a day for 50 years, you would make $2.5 million.

If you were to skip that coffee run and instead invest that $5 a day into the stock market, your coffee fund could grow to almost $11,000 in 5 years. Keep investing $5 a day for 50 years, and you could have more than $800,000.

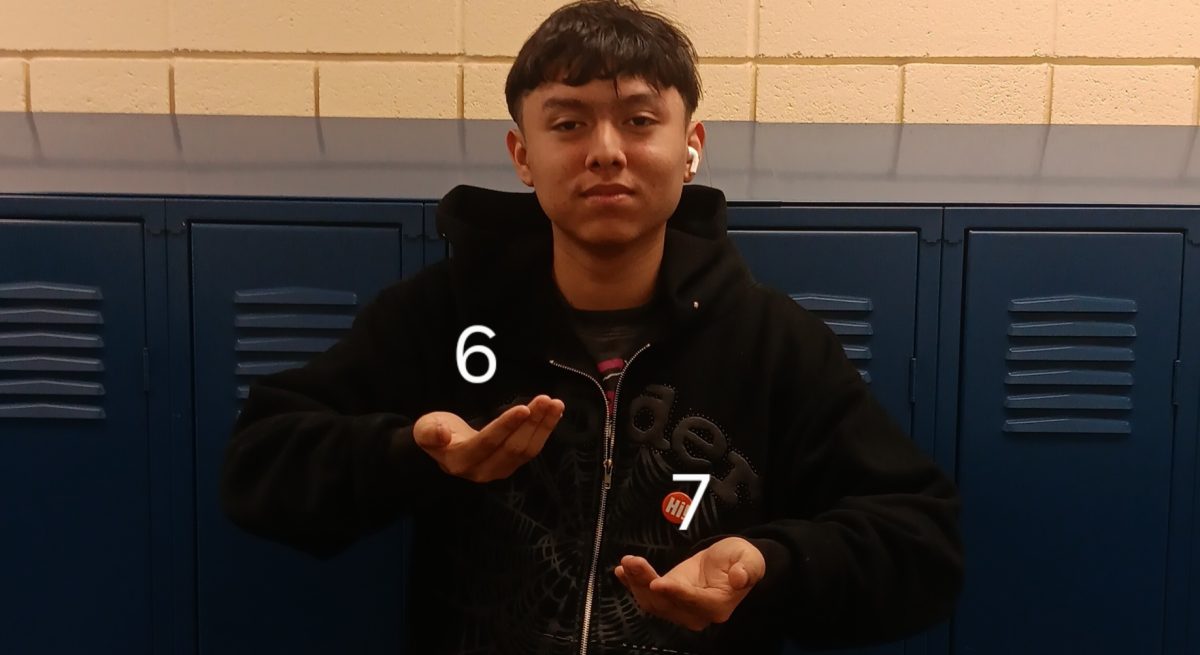

Why is it important to invest early? Kevin and Christian are good friends. Kevin started investing when he was 21 and put $2,400 in investments every year until he turned 30. He stopped investing at age 30.

On the other hand, Christian started investing at age 30 and put in $2,400 every year until he was 67. If you could guess who had more return on their investments you would probably say Christian. In reality, Kevin came out with more money than Christian even though Christian put more money into his stocks.

So why did this happen? By investing early, Kevin takes advantage of something called compound interest. Compound interest occurs when Kevin puts money into stocks and it builds more and more interest over time.

Interest is added to the original investment principal sum, in essence reinvesting the interest made. The interest in the next period is greater because the more times interest is added, the greater the interest earned, so the earlier the investment, the faster the growth.

In the last 10 years (2011-2021) the stock market increased 13.95%, which means if you had a dollar in the stock market in 2011 and let it sit, it would be worth $3.67 today. If you had a thousand dollars in the stock market in 2011, it would be worth $3,670 today.

Clint Myers is a financial adviser at West Michigan Advisers.. Myers believes it is important to start investing early. “The sooner you invest the better off you will be. We have a saying in our business: it’s not timing the market, it’s time in the market. The best friend an investor has is time. The more time you have, the higher probability of success.”

Instructor Jeremy Heavilin is a respected economics teacher at West Ottawa High School.“ I have investments,” Heavilin said. ”Once again investing is important to provide you with financial assets in the future, so that’s why we invest. My wife and I both have investments. Our children, daughter fourteen, and son eleven, also started to invest.”

Heavilin agrees that it is important to invest for your future. “Personally for me, it provides financial stability in the future.” Investing is smart, because if anything ever goes wrong, such as not being able to work, you have investments that will back you up.

“I started to invest right when I graduated from college,” Heavilin said. “Why wait when you can start right now. I wished I would have started from the first job I have ever had.”

He goes on by saying, “The biggest regret in my life is probably [when] I bought a pair of rollerblades for $125, that if today I would have invested that, I’d have, based on S&P 500 rates of return, probably about $3,000.”

Why wait when you know all of the benefits associated with investing for your future? Remember two things: first the best friend that an investor has is time, and second it’s not timing the market, it’s time in the market.

Well, I don’t have enough money to invest. You don’t need thousands of dollars to invest; you just need a good budget and a little extra money. By investing early, you get practice in making a budget so that later when you get more money you are able to handle it responsibly.

“My wife and I both contribute to a traditional IRA as well as a Roth IRA and we have 403Bs. I would say, conservatively probably around 15%,” said Heavilin.

Heavilin only invests 15% of his paycheck, which is nothing compared to people who spend most of their paycheck on going out and entertainment. Heavilin has three different investments which means only 5% goes to each investment.

By saving 50% of your paycheck for essentials like food and rent, 30% for entertainment and eating out, you still have 20% for investments.

This is simple math. By being diligent with your money you can have millions of dollars saved up for retirement or shorter term, have enough money saved for the new car you want.

You don’t need thousands of dollars for investments, you just need a small percentage of your paycheck.

I don’t know how to invest. You don’t need to be an expert on investing, you just need to find the right people that do. You can always find books on investing, and the internet has many different websites that discuss investing.

“Ask a trusted adult, could be a parent, could be an older sibling, could be a teacher. Where do they get their investment advice,” said Myer.

You always need to make sure that the person you’re getting your financial advice from is somebody you trust with your finances and not somebody that’s only looking at the news.

Myers goes on to say, “Make your investment decisions based on logic and data, and not based on news.”

It’s always good to know who has your best interest with your finances. There are some investors that only care about themselves and how they will profit off your finances.

Now that you have a better understanding of investing, are you ready to make your first investment? The most important thing in investing is to find a financial adviser that you trust, which means you might need to do some research on your own.

A place you could start your investing is West Michigan Advisors with Client Myers. West Michigan Advisors are investment fiduciaries which means by law they have to put the needs and the best interest of the customer ahead of their own, something every financial advisor should do.

By starting to invest early it will help you to have money later in life.

Start. Investing. Now.

Don’t forget that time is an investor’s best friend. And remember it’s not timing the market, it’s time in the market.